How To Make Money With Cash Back Credit Cards

Flat-rate cash back credit cards definitely have their advantages, especially for people who have no desire to keep track of rotating categories or earning caps.

With the Wells Fargo Active Cash℠ Card, for example, you can earn 2 percent back on all your spending with no annual fee. And with no bonus categories to keep track of, you don't have to wonder if you're using your rewards card the "right way."

Still, there are ways to boost rewards earned with a flat-rate cash back card. For the most part, you just have to be strategic with your shopping and be willing to take a few extra steps.

Here are six ways to maximize rewards with a cash back credit card from any of the major issuers.

1. Look for more bills you can pay with plastic

When you are earning rewards with a flat-rate cash back card, you'll inevitably earn more cash back the more you charge. With that in mind, it makes sense to look for new bills and expenses you can easily pay with a credit card.

Beyond basic expenses like groceries, gas and dining, see if you can pay for other bills with credit. For example, you may be able to pay your insurance premiums with your card, as well as your utility bills, your mortgage payment or rent, subscriptions and even daycare expenses.

2. Use cash back portals when you shop online

Any time you pay for something online with a credit card, you also have the opportunity to earn rewards with a cash back portal. For example, Rakuten lets you earn additional cash back when you click through the website before you shop with stores like Kohl's, Macy's, Nordstrom, Old Navy and Priceline.com. And remember, the cash back you earn with this portal is offered on top of the cash back you earn with your credit card.

Other cash back apps and portals to check out include TopCashBack, Cashback Monitor and Ibotta.

3. Utilize card issuer rewards portals

Some card issuers also have their own portals that let you earn additional cash back. If you have the Chase Freedom Unlimited or the Chase Freedom Flex, for example, you can click through the Chase portal before you shop to earn more cash back on all your purchases.

While stores in the Chase shopping portal can vary, they frequently include options like Walmart, Sephora, Best Buy and Macy's.

Meanwhile, Barclaycard has its own shopping portal known as RewardsBoost, and Wells Fargo has the Earn More Mall.

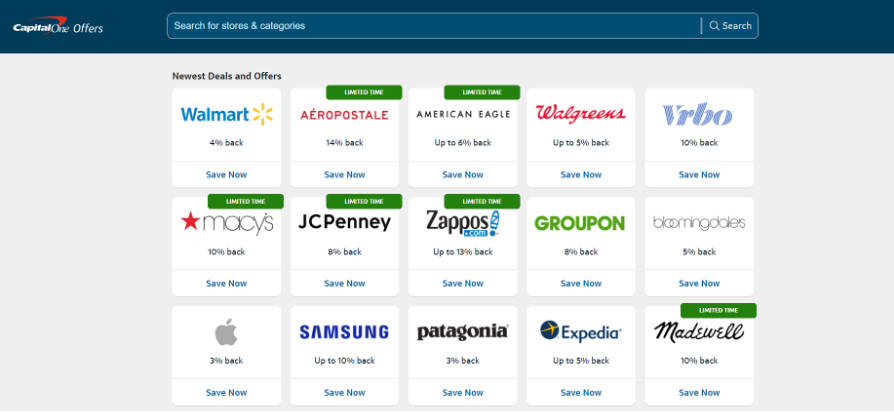

4. Special offers from Chase, American Express and Capital One

You can also check for additional cash back offers if you have an American Express credit card, a cash back credit card from Chase or a rewards credit card from Capital One. Each of these card issuers has additional offers you can add to your card to gain extra savings or earn more cash back.

With Capital One Offers, for example, individuals who have flat-rate cash back credit cards like the Capital One Quicksilver Cash Rewards Credit Card or Capital One QuicksilverOne Rewards Credit Card can earn more cash back. To do so, all they have to do is log into their account and "click through" the portal before they shop.

Also check for additional offers from other card issuers, such as Chase Offers and Amex Offers.

Cash back percentages vary from store to store, and there are usually limits that cap how much additional cash back you can earn. Either way, these special offers are all given on top of the cash back you would normally earn with your credit card. They're also easy to add to your card and use, so you should try to take advantage if you can.

5. Never carry debt

Meanwhile, it's hard to imagine how you could maximize cash back without keeping your eyes on your balance and monthly payment. After all, the high interest rates credit cards charge can cost you a lot more than you're earning in cash back.

If your goal is racking up as much cash back as possible, you really do need to stay out of debt and avoid carrying a balance. You can do this by only charging purchases you can afford to pay off, tracking your spending throughout each billing period and faithfully paying your entire balance in full and on-time each month.

This part isn't as exciting as earning cash back, but staying out of debt is much more important.

6. Consider pairing a flat-rate card with a bonus category card

Finally, you can consider pairing your flat-rate card with one that offers more rewards in bonus categories—but only if you really want to. This strategy can make it more complicated to earn rewards, but it can help you earn a higher rate of cash back on your spending.

To pair cards without overcomplicating your life, you should really just pick one other rewards card to go with your flat-rate card. Specifically, you should pick a card that offers really generous rewards in the categories you spend the most in.

If you spend a lot on groceries, travel and dining, for example, you could pair your flat-rate card with an option like the Chase Freedom Flex. This card doesn't charge an annual fee, yet you earn 5 percent cash back on activated bonus category purchases each quarter (up to $1,500 in purchases, then 1 percent) and on Chase Ultimate Rewards travel purchases. You also earn 5 percent cash back on Lyft rides (through March 2022) and on up to $12,000 in grocery store purchases (not including Target® or Walmart® purchases) in the first year, as well as 3 percent cash back on dining (including restaurants, takeout and eligible delivery services) and drugstore purchases. Since the Chase Freedom Flex only offers 1 percent back on regular spending, however, you would use your flat-rate card with a higher cash back percentage for all other purchases.

If you spend a lot on dining and entertainment, you could consider the Capital One Savor Cash Rewards Credit Card due to its 4 percent back rate on those purchases, along with select streaming services.

There are many cash back credit cards to consider, all of which have different features and earning rates. Make sure to compare all the best credit card offers on the market today if your goal is finding a few cards to pair together for optimal rewards.

The bottom line

There are plenty of reasons to pick a flat-rate cash back credit card, including if you just don't want to juggle more than one. After all, flat-rate cards let you earn a higher-than-average rewards rate on all your purchases and bills. In the meantime, they can help you simplify your life and your finances.

You can still try to earn as much cash back as possible, even if that just means finding a few more bills you can easily pay with your rewards credit card. By clicking through shopping portals, taking advantage of special card issuer offers and pairing your flat-rate card with a card with bonus categories, the difference could add up to hundreds of dollars in additional cash back each year.

How To Make Money With Cash Back Credit Cards

Source: https://www.bankrate.com/finance/credit-cards/maximize-flat-rate-cash-back-cards/

Posted by: hollandapenscher.blogspot.com

0 Response to "How To Make Money With Cash Back Credit Cards"

Post a Comment